Due diligence doesn’t have to be exhausting and time-consuming in today’s digitized, automated, and AI-driven world. What if your business can cut document review time by half and save up to 80% of the cost? It’s very possible with due diligence automation.

Keep reading to explore the tools and best practices for automating your due diligence workflows.

4 challenges of manual due diligence

Manual due diligence involves a hands-on approach when DD teams collect data without specialized technological tools. Businesses face the following challenges with manual diligence processes:

- High costs

- Human error

- Inconsistent results

- Scalability issues

High costs

Due diligence typically takes 60–90 days and requires a coordinated effort by law firms which boosts costs. For example, in-house investigations and legal advisory services may take $600,000 in fees for a $100-million deal. Manual due diligence requires more human- hours and, therefore, costs may reach $900,000–$1,200,000.

Human error

Studies show that data entry error rates can be as high as 6%, while the commonly accepted rate is 1%. This fact creates several challenges for manual due diligence processes. First, collected data has inherent errors, and DD teams must adjust that while managing risk, evaluating funds, or planning integrations.

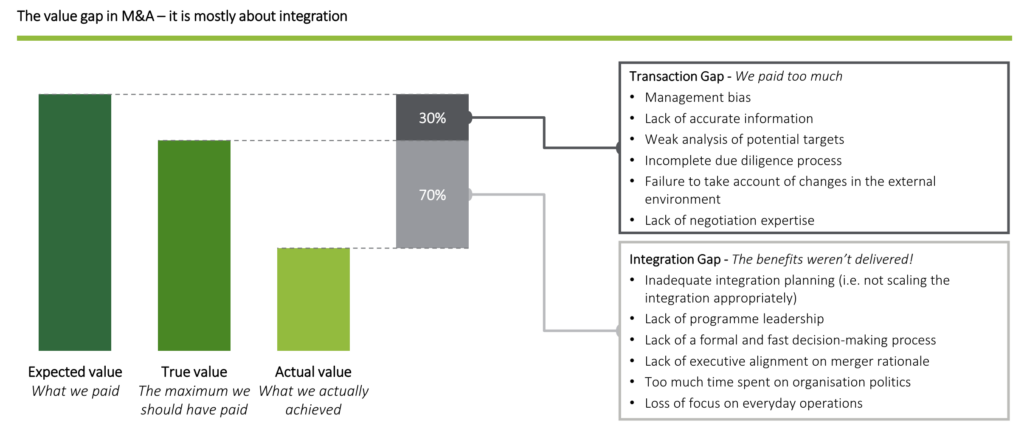

Second, manual data entry during due diligence creates an additional layer of errors. As a result, due diligence reports based on incorrect financial data may deliver unrealistic valuations and expectations. That is a common scenario — M&A acquirers typically overpay 30%.

Inconsistent results

Companies often make decisions based on incomplete, inaccurate, and inconsistent information. Inconsistencies occur when different DD teams collaborate and analyze documents in isolation. This process creates a couple of issues:

- Inconsistent data. Due diligence teams collect data from different sources without exchanging and adjusting values.

- Knowledge gaps. As functional teams may access very different data sources, they produce inconsistent findings and knowledge gaps.

| ✏️ Check out our seven financial due diligence software picks + comparison tables. |

Scalability issues

Acquirers that close multiple small and mid-sized deals yearly are statistically over 200% more successful than infrequent dealmakers. This approach requires scalable due diligence teams capable of processing five or even ten targets yearly.

Unfortunately, manual due diligence cannot be scaled efficiently and often fails to meet increasing business demands. To be capable of pursuing programmatic M&A, the most efficient M&A strategy, acquirers need automated due diligence.

4 benefits of automated due diligence

Due diligence process automation provides companies with the following benefits:

- High efficiency

- High accuracy

- High scalability

- Cost reduction

High efficiency

Automated due diligence offers significant efficiency improvement due to the following factors:

- Time-saving process. Automated systems spend less time collecting and categorizing data points and DD teams valuable insights for in-depth document analysis.

- Uninterrupted process. Automated data analytics systems can continuously operate without human supervision. This way, DD teams substantially accelerate document collection, which is critical for time-sensitive transactions like IPOs.

| ✏️ More insights: Discover the six areas to investigate in IPOs and learn how to create an in-depth IPO due diligence checklist. |

High accuracy

The following factors make automated due diligence more accurate:

- Fewer errors. Automated tools reduce data entry errors. Due Diligence professionals significantly improve data accuracy by dealing only with inherent errors in raw, unstructured data.

- Reduced inconsistencies. It’s easy to standardize data collection with automated solutions. Human analysts can access unbiased, standardized, and multi-source data sets and generate comprehensive insights.

High scalability

Automated due diligence work can be scaled efficiently due to the following factors:

- Process automation. Automated systems are designed to process large data volumes consistently. Companies can conduct due diligence on multiple targets simultaneously without risking quality and productivity.

- High adaptability. Companies can scale automated systems up or down based on due diligence needs. It makes DD teams highly flexible and adaptable to business challenges.

Cost reduction

Specifics of automated due diligence reduce the time and effort required for quality results:

- Operational savings. Companies can scale automated systems without significantly increasing costs. In contrast, high labor expenses are required to scale manual processes.

- HR savings. Automation reduces reliance on significant human resources. Due diligence teams can deliver higher productivity with less effort and quicker.

- Overhead savings. Workflow automation reduces data entry, reporting, distribution, and other administrative needs.

10 key features of due diligence automation tools

Here are the key features of automation tools that increase due diligence accuracy and effectiveness:

- Multi-source data scraping

- API connectivity

- Machine learning

- Optical character recognition

- Robotic process automation (RPA) bots

- Q&A workflows

- Automatic index numbering

- Automatic PDF conversion

- Audit trails

- Scheduled activity reports

Multi-source data scraping

Web data harvesting automatically collects relevant data from many sources, including databases, websites, and social media. It ensures unbiased, comprehensive coverage of topics under investigation and promotes informed decisions.

API connectivity

Application programming interfaces (API) technology allows DD teams to pull data from multiple web applications into a shared environment. It drastically reduces the data integration time and helps professionals begin comprehensive data analysis as quickly as possible.

Machine learning

Machine learning, natural language processing, and artificial intelligence algorithms identify patterns in large data volumes. Artificial intelligence (AI) tools streamline data analysis by detecting anomalies, potential risks, and opportunities. Human and AI capabilities offer in-depth, actionable insights and risk assessments and ensure unmatched accuracy of business intelligence.

Optical character recognition

Optical character recognition extracts text patterns from scanned documents and transforms them into editable and searchable data. This technology converts paper documents and images into PDFs that are available for e-signature, redaction, and more convenient analysis.

Robotic process automation bots

Robotic process automation (RPA) bots perform web scraping, email parsing, API connections, data entry, and other repetitive tasks. This technology improves data entry accuracy and frees up time for in-depth analysis and planning.

Q&A workflows

Question and answer workflows auto-forward topic questions, like a tax due diligence checklist or integration checklist, to dedicated subject matter experts. These systems also support file referencing and discussions. This technology organizes communication flow between buy-side and sell-side teams, promotes cross-functional collaboration, and ensures informed decision-making.

Automatic PDF conversion

Automatic file conversion engines convert numerous file formats into PDFs. Many engines support over 25 file types. This technology reduces data preparations in virtual data rooms and standardizes document reviews.

Automatic index numbering

Index numbering assigns numbers to key data points and documents in the content structure. It reduces the need for manual index updates and improves content organization in the workspace.

Audit trails

Audit trails log all actions taken in the workspace, including document changes, administrative changes, and collaborators’ activity. It provides transparency and accountability to due diligence workflows and promotes easy referencing, internal risk assessment, and version control.

Scheduled activity reports

Due diligence tools like virtual data rooms generate and distribute periodic activity reports. This feature reduces administrative costs and ensures high team accountability without manual intervention.

Using VDRs for automated due diligence processes

Virtual data rooms (VDRs) are the optimal solutions for automated due diligence. Leading VDRs offer many due diligence automation features:

- Optical character recognition

- Q&A workflows

- Automatic PDF conversion

- Automatic index numbering

- Drill-down scheduled activity reports

- Audit trails

- API connectivity

In addition to powerful automation features, data rooms offer several more benefits for due diligence:

- Central data repository. Store all due diligence materials in one secure synced space. Centralizing information in a data room minimizes data requests.

- Technology integration. Connect your VDR to other applications and access extra capabilities, like single sign-on (SSO), e-signature, and AI algorithms.

- Built-in redaction. Remove sensitive information from contracts and agreements in a convenient redaction interface.

- Granular access permissions. Control access to documents, folders, and subfolders in the cloud and on user devices. Assign bulk permissions to as many users as needed.

- Bank-grade encryption. Protect sensitive data with AES 256-bit encryption — at rest and in transit — and control encryption keys.

- Compliance automation. Ensure business compliance by working in ISO 27001, HIPAA, HITRUST, GDPR, and CCPA-compliant environments.

Check these five best data rooms for automated due diligence

Ideals

- Access controls

- Built-in viewer

- Full-text search

- Auto-indexing

- Customizable branding

- Advanced Q&A

- In-app live chat support 24/7

- 30-second chat response time

Dealroom

- Access controls

- Built-in viewer

- Full-text search

- Auto-indexing

- Customizable branding

- Advanced Q&A

- In-app live chat support 24/7

- 30-second chat response time

Citrix

- Access controls

- Built-in viewer

- Full-text search

- Auto-indexing

- Customizable branding

- Advanced Q&A

- In-app live chat support 24/7

- 30-second chat response time

Box

- Access controls

- Built-in viewer

- Full-text search

- Auto-indexing

- Customizable branding

- Advanced Q&A

- In-app live chat support 24/7

- 30-second chat response time

Intralinks

- Access controls

- Built-in viewer

- Full-text search

- Auto-indexing

- Customizable branding

- Advanced Q&A

- In-app live chat support 24/7

- 30-second chat response time

Implementing automated due diligence: 4 best practices

Follow these due diligence automation best practices:

- Evaluate current processes

- Outline automation tools

- Integrate new systems

- Train due diligence teams

Evaluate current processes

Understand the areas needing improvement and efficiency gaps in your due diligence process. Our findings indicate that the following self-assessment questions help companies identify due diligence gaps:

- What degree of automation do we have? Do manual processes prevail?

- What tools and services do we use for due diligence?

- How many sources do we collect data from?

- How long does it take to collect due diligence data?

- Do we have recurrent delays in data collection?

- Do our DD teams collect data from the same sources?

- How often do we detect discrepancies in collected data?

- How do we coordinate DD teams?

- How do we manage, share, and analyze data? Do we have a central data repository?

- How many tasks are repetitive? Which due diligence tasks can be optimized?

Outline automation tools

Decide which automation capabilities can close efficiency gaps in your due diligence process. Which due diligence aspects do you need to improve the most?

Is it data collection, accuracy, analysis, or everything at once? Or do you need a central repository, like a virtual data room, to store due diligence data? Understanding this will help you select appropriate automation tools. Actions to take:

- Decide on the budget. Research automation tools.

- Select those that match your needs.

- Test and try automation solutions (free trials, demo versions, free versions).

| ✏️ Pro tip: Check how a free data room for startups differs from a premium one. |

Integrate new systems

Based on our experience, you can assume that migration from one workspace to another may take about 30 days. So, consider the following steps:

- Review regulatory compliance specifics of the selected automated solution and upcoming data migration activities.

- Create a migration/implementation timeline with key milestones.

- Backup all data and inform stakeholders.

- Conduct test data migration and collect critical insights.

- Test the functionality of new systems and migrate data.

- Clean your previous workspace.

Train your due diligence teams

Training is indispensable because organizations offering training programs have 24% higher profit margins. So here is how you can train your employees to use new due diligence systems:

- Provide user manuals and FAQs. You can set interactive FAQ sections directly in data rooms.

- Organize training sessions. You can contact VDR vendors to arrange training sessions and involve dedicated project managers.

- Incentivize employees. Offer performance bonuses, training rewards, paid time off, and paid training time.

Key takeaways

- Manual due diligence has many issues, from low efficiency and poor scalability to high costs and data errors.

- Automated due diligence makes it simpler for acquirers to close several deals a year and outperform industry peers by over 200%.

- Web scrapers, data rooms, and machine learning interfaces are key tools for due diligence automation.

- Understand efficiency gaps, train employees, and test various tools to automate due diligence successfully.