Dec 26 ‘23

38 min read

A virtual data room (VDR) is a surefire way to smoothly conduct the due diligence (DD) process. It allows businesses to collaborate and manage confidential documents in a synced ecosystem with bank-grade security.

VDRs also provide templates to help companies conduct business assessments. Companies also develop proprietary due diligence checklists to enhance VDR workflows. This article explores the following aspects of the data room documents checklist:

- 7 business areas under M&A due diligence

- 4 DD challenges VDR checklists address

- 167 data room items for successful M&A

Ideals

- Access controls

- Built-in viewer

- Full-text search

- Auto-indexing

- Customizable branding

- Advanced Q&A

- In-app live chat support 24/7

- 30-second chat response time

Dealroom

- Access controls

- Built-in viewer

- Full-text search

- Auto-indexing

- Customizable branding

- Advanced Q&A

- In-app live chat support 24/7

- 30-second chat response time

Citrix

- Access controls

- Built-in viewer

- Full-text search

- Auto-indexing

- Customizable branding

- Advanced Q&A

- In-app live chat support 24/7

- 30-second chat response time

Box

- Access controls

- Built-in viewer

- Full-text search

- Auto-indexing

- Customizable branding

- Advanced Q&A

- In-app live chat support 24/7

- 30-second chat response time

Intralinks

- Access controls

- Built-in viewer

- Full-text search

- Auto-indexing

- Customizable branding

- Advanced Q&A

- In-app live chat support 24/7

- 30-second chat response time

Defining purpose and scope

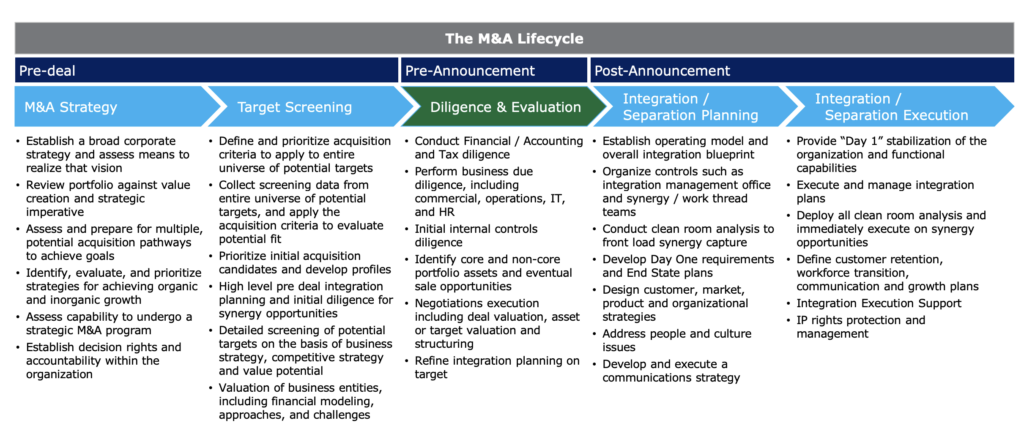

Due diligence is a comprehensive investigation an acquiring company conducts on a target company before closing an M&A transaction.

DD is developed by the M&A governance unit and conducted by functional teams. It helps to evaluate M&A targets, detect synergies, prevent risks, and integrate businesses.

Due diligence purposes require an acquiring party to dive deep into the following business functions of the target company:

- Financial

- Commercial

- Operations

- IT technology

- Tax

- Human resources

- Legal

When do companies need a due diligence data room checklist?

Target investigations can take over 90 days, with companies facing quality data issues and organizational hiccups across all six due diligence process phases. However, successful dealmakers heavily rely on dedicated M&A technology such as virtual data rooms when conducting due diligence.

A virtual data room is a secure workspace with M&A workflows, including Q&A, DD checklists, pipeline management, redaction, and team collaboration.

Accenture’s research has revealed that M&A tools, including virtual data rooms, can reduce the M&A lifecycle speed by three months and unlock up to $45 million in extra value for sellers and up to $30 million for buyers.

4 due diligence challenges addressed with the virtual data room checklist

Why is a checklist in a data room important? Successful dealmakers use data room checklists to address organizational and data management challenges. Based on our experience, a company should leverage an M&A data room checklist if it faces the following DD challenges.

| Due diligence challenges |

Data room value |

Checklist value |

| A company fails to articulate due diligence requirements. |

VDRs provide a bigger picture of the process and ensure 24/7 access to DD files. |

M&A documents laid out in a due diligence framework are easy to oversee. |

| Functional teams cooperate only among themselves, failing to exchange critical insights. |

A virtual data room ensures centralized communication between collaborators. A workspace with 24/7 access to M&A materials enhances cross-functional collaboration. |

The checklist serves as a central reference point for cross-functional teams. Sharing due diligence requests in the data room helps DD teams coordinate contract review processes. |

| Productivity deteriorates due to poor document organization across disconnected technologies. |

Automatic document indexing, document labeling, full-text search, and interactive document structures in VDRs help leadership and functional teams collect, categorize, and organize critical information. |

Enhanced with data room features, DD checklists ensure well-organized data storage and process tracking. |

| Security and data breaches involve catastrophic consequences for the due diligence process and deal value. |

Virtual data rooms secure due diligence workflows with granular access permissions, zero-trust authentication policies, and information rights management (IRM) tools. Bank-grade security throughout the M&A lifecycle minimizes data breach chances. |

Data room checklists with automatic Q&A workflows and notifications simplify security and compliance management. |

| Learn how to maximize due diligence organization with an effective data room structure. |

Data room due diligence checklist case study: Ideals + StoneX Group Inc

StoneX, a century-old financial services franchise with over 300 OTC products and over $4.4 trillion in traded volume, has used Ideals virtual data room for DD and M&A since 2018.

Industry: Financial services, commercial hedging, global payments.

Pre-VDR challenges:

- StoneX experienced security challenges using traditional file-sharing solutions.

- StoneX’s DD workflows lacked document organization.

- The company required prompt information exchange and activity tracking.

VDR impact:

- Secure data storage and confidential document handling protected StoneX’s workflows.

- Bulk document actions, document labels, optical character recognition (OCR) search, and automatic indexing helped StoneX organize due diligence materials across several projects.

- Collaborating with bidders on separate projects helped the company retain workflow independence and reduce communication breakdowns. It improved overall deal room efficiency in all 34 StoneX projects.

VDR checklist impact: Developing, exchanging, and tracking DD checklists allowed StoneX’s DD teams to gauge more documents, reveal hidden issues, and improve transaction risk management.

List of essential data room documents

Naturally, depending on the M&A goals, the specifics of the due diligence requirements will also vary. Below is a universal yet comprehensive list of important documents to include in a virtual data room, categorized by business functions:

- Financial

- Commercial

- Operations

- IT technology

- Tax

- Human resources

- Legal

1. Financial

According to the Deloitte survey, companies overlook financial issues to the extent that achieved values are 70% lower than anticipated. Also, acquirers overpay 30% on average as they fail to make accurate financial assessments.

That is why quality financial DD is critical for post-deal success. It evaluates the target’s financial health and allows the acquirer to make an informed financial decision. If your business is seeking future investment or is considering mergers and acquisitions opportunities, make sure to add these financial documents in a data room.

| Financial aspect | Documents |

| Financial statements and reports |

Equity capitalization table (cap table) |

|

Copies of unaudited financial statements |

|

|

Copies of audited financial statements (for at least the last three years) |

|

|

Pro forma statements for the next year |

|

|

Balance sheets |

|

|

Profit and loss statements |

|

|

Cash flow statements |

|

|

Accounts receivable and accounts payable reports |

|

|

Working capital reports |

|

|

Financial reporting controls |

|

| Financial metrics and projections |

Third-party financial evaluations |

|

Cash flow projections |

|

|

Budgets |

|

|

Revenue and operating expense projections |

|

|

Capital expenditure plans |

|

|

Key metrics and ratios: market, profitability, liquidity, solvency, efficiency |

|

|

Sensitivity analyses |

|

| Assets and investments |

Investment portfolio breakdown |

|

Historical documents on previous fundraising transactions |

|

|

Venture capital financings |

|

|

Fixed asset register |

|

|

Asset maintenance procedures and expenditures |

|

|

Asset management files |

|

|

Depreciation schedules |

|

|

Inventory valuation reports |

|

|

Inventory turnover ratios |

|

|

Property valuation reports |

|

| Debt and liabilities |

Debt schedule |

|

Contingent liabilities |

| Check an elaborated financial due diligence checklist for the most accurate deal valuations. |

2. Commercial

Commercial due diligence investigates the target company from a business perspective, determining its performance, market conditions, and competitive landscape. It is a crucial part of deal valuation and provides insights into the strategic fit of the entire transaction.

| Commercial aspect | Documents |

| Market |

Industry reports |

|

Target’s historical and projected performance against industry benchmarks |

|

|

Target’s market position |

|

|

Competitor analysis |

|

|

Pitch deck |

|

| Customers |

Past and current customer lists |

|

Customer satisfaction metrics |

|

|

Strategic partnership agreements |

|

|

Customer compliance records |

|

| Sales and marketing materials |

Target’s business plan |

|

Brand positioning and awareness metrics |

|

|

Sales strategies and marketing plans |

|

|

E-commerce strategies and online presence |

|

|

Target’s SWOT analysis |

|

|

Distribution channels |

|

|

Product lines |

|

|

A product roadmap |

|

|

Pricing strategies |

3. Operations

Successful post-merger integration (PMI) contributes to 23% of M&A success, based on the Deloitte survey. However, over 60% of surveyed executives fail to realize post-merger synergies and integration targets.

Operations, the primary income driver for the merged entity, require careful investigations. Operational DD helps the acquirer understand integration vectors and develop actionable PMI plans.

| Operational aspect | Documents |

| Production |

Standard operating procedures and production workflows |

|

Quality control processes and reports |

|

|

Capacity utilization reports |

|

|

Equipment maintenance reports |

|

|

Operational risk assessment reports |

|

|

Environmental investigations |

|

| Supply chains |

Supplier lists |

|

Supplies metrics and performance reports |

|

|

Logistics and distribution performance records |

|

|

Inventory management reports |

|

| Health and Safety |

Workplace health and safety policies and procedures |

|

Incident reports |

|

|

Emergency response plans |

4. IT technology

Over 70% of executives consider technology an M&A value driver, while 80% of excellent deal performers emphasize technology, the Accenture report says. At the same time, technology is a considerable risk.

As much as 96% of Chief Information Officers (CIOs) revealed technology issues (during due diligence) impacting deal outcomes. Thorough technology due diligence reveals IT integration opportunities, technology value drivers, and, most importantly, cybersecurity issues resulting in multi-million data breaches.

| Technology aspect | Documents |

| Infrastructure |

Hardware and server inventory reports |

|

Network architecture documentation |

|

|

Cloud service usage reports |

|

| Software applications |

Lists of software applications and licenses |

|

Software usage reports |

|

|

Software update policies |

|

|

Software documentation packages |

|

| Cybersecurity |

Cybersecurity policies and procedures. |

|

Security controls |

|

|

Incident response plans |

|

|

Third-party cybersecurity audits |

|

|

Penetration testing reports |

|

|

Incident reports |

|

|

Disaster recovery plans and testing records |

|

| Data privacy and protection |

Privacy policies |

|

Data protection policies and practices |

|

|

Data incident reports |

|

| Technology integration |

Technology integration roadmaps |

|

Integration risk reports |

|

|

Service documentation |

5. Tax

Poor tax due diligence (TDD) results in improper deal valuation, unexpected expenses during PMI, and tax litigations. Thus, information about taxes is important to include in virtual data rooms for almost any deal type because it’s always a priority for potential investors to investigate. These are the tax documents in the data-room-for-investors checklist.

| Tax aspect | Documents |

| Tax policies |

Information on tax policies |

|

Transfer pricing documentation |

|

| Tax compliance |

Tax returns for the last two years |

|

List of jurisdictions where a target company pays taxes and files tax returns |

|

|

Internal tax compliance controls and procedures |

|

|

Schedule of upcoming tax compliance filings |

|

| Tax audits |

Schedule of completed tax audits for the last five years |

|

Tax authority correspondence |

|

|

Records of tax disputes |

|

| Tax reserves and liabilities |

Tax reserves on the balance sheet |

|

Contingent tax liabilities |

|

|

Tax exposure provisions |

6. Human resources

As much as 30% of M&A transactions fail to meet desired financial outcomes due to cultural issues, common points of human resource (HR) management, Mercer’s report says. Culture clashes in M&A outline the importance of due diligence on the sell-side HR.

It allows merging entities to develop successful HR integration plans and maximize cultural alignment. HR due diligence is also where virtual data room security is especially important. Below are a few examples of HR-related documents to include in a data room.

| HR aspect | Documents |

| Workforce composition |

Organizational charts and reporting channels |

|

Employee demographics reports |

|

|

Key employee resumes |

|

|

Turnover reports |

|

|

Employee complaint records |

|

| Employee benefits and policies |

Benefits policies |

|

Policies regarding sick days, overtime, and paid holidays |

|

|

Appraisal policies |

|

|

Insurance policies |

|

|

Retirement plans and pension documentation |

|

|

Employee handbooks |

|

| Training and development |

Details about training programs |

|

Professional development plans and opportunities |

|

|

Employee certifications |

|

|

Leadership succession planning programs |

|

| Compensation |

Employee compensation structures |

|

Incentive plans |

|

|

Payroll records |

|

| Corporate culture and employee relations |

Corporate value and belief summaries |

|

Leadership practice summaries |

|

|

Decision-making approach analyses |

|

|

Employee satisfaction reports |

|

|

Employee engagement initiatives |

|

|

Corporate culture assessments |

|

|

Stakeholder communication reports |

|

| Labor union |

Labor union negotiations and relationship history |

|

Related disputes and resolutions |

7. Legal

Legal DD includes general information about the business, its owners, all the legal aspects of previous transactions, etc. It explores existing and potential issues in all the legal documents before, during, and after the transaction.

Successful legal document organization and review saves the deal, while overlooked issues, especially in the anti-trust realm, may dissolve mergers before closing agreements. Thus, 10% of large deals ($1 – $10 billion +) get canceled before finalization according to McKinsey. These are some of the most common legal documents required for an effective data room request list.

| Legal aspect | Documents |

| General information |

Articles of incorporation and bylaws |

|

Organizational chart showing the corporate structure, including all the subsidiaries |

|

|

Records of board meetings |

|

|

List of jurisdictions where a target company is licensed |

|

| Financial |

Loan agreements |

|

Shareholder agreements |

|

|

Purchase agreements relating to the past, current, and future mergers and acquisitions rounds |

|

|

Equity and debt insurance |

|

|

Notable material contracts |

|

|

Guarantees and indemnities |

|

|

Warranties and representations |

|

| Commercial |

Vendor agreements |

|

Distributor agreements |

|

|

Licensing agreements |

|

|

Sales and marketing contracts |

|

|

Franchise agreements |

|

|

Joint venture agreements |

|

| Operations |

Equipment and property leases |

|

Manufacturing agreements |

|

|

Service level agreements (SLAs) |

|

|

Insurance policies |

|

|

Research and development agreements |

|

| IT technology |

Escrow agreements |

|

Technology transfer agreements |

|

| Human resources |

Employment agreements and contracts |

|

NDAs and NSAs |

|

| Compliance |

Information about certifications and compliance a target company corresponds to |

|

Tax regulation compliance records |

|

|

ESG compliance reports |

|

|

Data security and privacy compliance certificates |

|

|

Antitrust filings |

|

|

Regulatory approvals and permits |

|

|

Open source software compliance verification records |

|

| Intellectual property (IP) |

Schedule of owned proprietary technology (software, systems, and databases) |

|

Trademarks, brand names, slogans, logos, etc. |

|

|

Copyrights |

|

|

Domain names |

|

|

IP licensing agreements |

|

|

IP registration records |

|

|

IP-related contracts |

|

|

IP valuation reports |

|

|

IP security agreements |

|

| Disputes and litigations |

Legal disputes |

|

Intellectual property infringements |

|

|

Past, current, and pending insurance disputes |

|

|

History of legal settlements |

Key takeaways

- Data-room-powered DD checklists ensure safe collaboration, help companies clarify DD requirements, and enhance security compliance.

- A data room checklist contains documents from the main DD areas, including financial, commercial, operations, IT technology, tax, human resources, and legal.

- M&A industry statistics indicate that successful businesses carefully plan DD content within their data rooms to reveal transaction issues early and maximize deal outcomes.

- The content of the VDR checklist depends on your individual goals. By relying on the universal recommendations given above, you can create your checklist. However, you can also ask your VDR provider to assist you with the correct data room setup and a more detailed data room checklist.

Category

Data roomsFAQ

Agreements, reports, and reviews from financial, commercial, operations, IT technology, tax, human resources, and legal areas are essential for an M&A data room.

Successful businesses update data rooms continuously based on the M&A progress and automatically record actions in audit trails. Active data room users may update VDR content daily as they complete M&A tasks.

Having an investor data room checklist is advisable for startups. A well-organized data room for startups builds trust, ensures a professional approach, and provides bank-grade security. These features enhance the fundraising process.